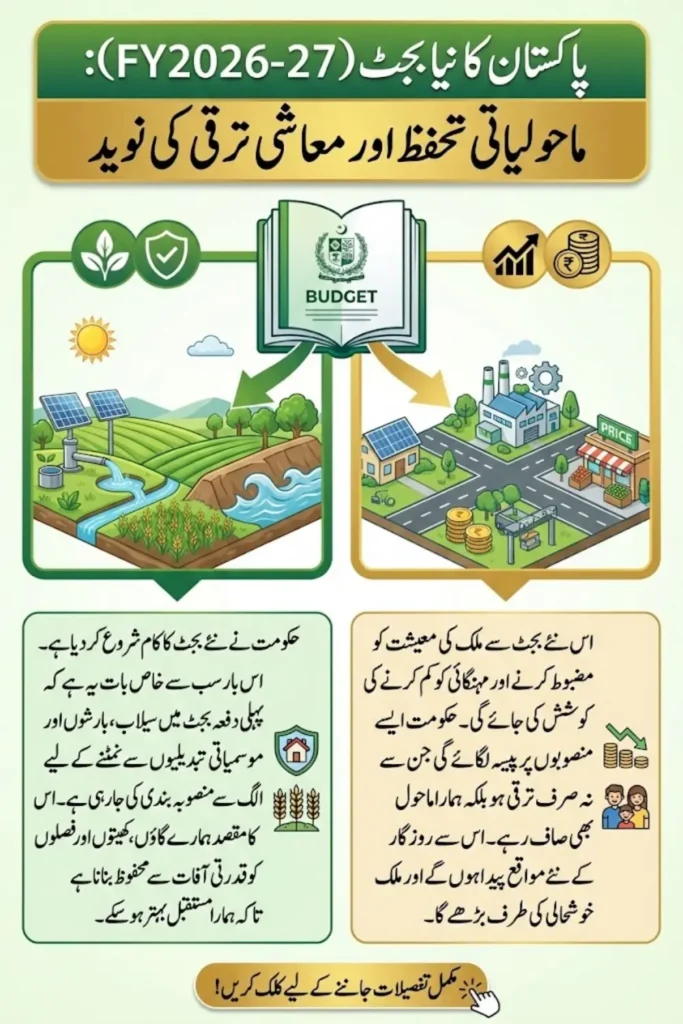

Pakistan FY2026-27 Budget Process Launched: Climate-Focused Reforms and Macroeconomic Priorities

Pakistan Kicks Off FY2026-27 Budget Process

The Government of Pakistan has officially initiated the FY2026-27 budget process by issuing the Budget Call Circular (BCC). This marks the beginning of preparations for the federal budget, outlining macroeconomic priorities, detailed timelines, and the integration of climate and disaster-related considerations. The Finance Division projects GDP growth of 5.1 percent for FY2026-27 and an inflation rate of 6.5 percent, signaling steady economic recovery and stabilization.

Pakistan FY2026-27 Budget Process

Climate-focused reforms and macroeconomic priorities for next fiscal year

📈 Macroeconomic Framework

Projected GDP growth and inflation rates

- GDP growth: 5.1% for FY2026-27

- Inflation: 6.5%

- Guides ministries on revenue & expenditure planning

🌱 Climate & Green Budgeting

Revenues and subsidies tagged for environmental impact

- Categories: Energy, Transport, Pollution, Natural Resources

- Revenue examples: petroleum levies, vehicle taxes, resource fees

- Ensures fiscal policies support sustainability

💸 Climate Tagging of Subsidies

Subsidies classified by adaptation/mitigation & impact

- Impact categories: Directly favourable, Indirectly favourable, Neutral, Mixed, Potentially unfavourable

- Supports climate-resilient and clean energy initiatives

- Standardized Form III-C used by ministries

🌪️ Disaster Budgeting

Tagged expenditures for pre- & post-disaster actions

- Covers prevention, mitigation, preparedness

- Post-disaster: response, recovery, reconstruction

- Cost centres assigned for transparency and tracking

📅 Budget Timeline

Key dates for FY2026-27 preparation and approvals

- Feb 20: Submission of revised estimates

- Mar 30–Apr 12: Budget Review Committee meetings

- End May: Finalization of all budget documents

🏛️ Significance

Enhancing fiscal accountability and sustainability

- Systematic tagging strengthens public finance transparency

- Balances economic recovery, climate mitigation, and disaster preparedness

- Supports long-term sustainable development goals

This budget cycle also introduces innovative climate-focused reforms. For the first time, federal agencies are required to tag revenues, subsidies, and expenditures for their environmental impact. These measures aim to improve accountability, promote green growth, and ensure that fiscal policies align with sustainability objectives while supporting Pakistan’s broader economic goals.

Also Read: State Bank Of Pakistan Launched Zarkhez-e Scheme – 1 Million Loan for Small Farmers

Provisional Macroeconomic Framework for FY2026-27

The government’s provisional macroeconomic framework projects GDP growth to increase from 4.0 percent in FY2025-26 to 5.1 percent in FY2026-27. Inflation is expected to ease from 6.1 percent to 6.5 percent over the same period, aided by moderating global commodity prices and ongoing structural reforms.

These projections are designed to guide federal entities in preparing realistic revenue and expenditure estimates. Ministries are instructed to submit actuals for FY2024-25, revised estimates for FY2025-26, and budget proposals for FY2026-27, ensuring consistency across all sectors and improving fiscal discipline.

Also Read: State Bank of Pakistan Loan Scheme 2025 For Homeless People

Climate and Green Budgeting Initiatives

For the first time, Pakistan’s budget process introduces detailed guidance on green budgeting. All federal entities must identify and classify revenues with environmental relevance, covering both tax and non-tax streams. The goal is to ensure that public finances contribute to climate resilience and sustainable development.

Key features of the climate-focused revenue tagging include:

- Categorizing revenues under Energy, Transport, Pollution, and Natural Resources.

- Including petroleum levies, greenhouse gas emissions, road usage fees, and water/forest resource charges.

- Evaluating non-tax revenues based on environmental impact to align with climate objectives.

Also Read: BYD Atto 2 Pakistan: Limited-Time Offer Includes Free Charger, Insurance, and Charging Coupons

Table: Green Revenue Categories

| Category | Examples of Revenues | Environmental Relevance |

|---|---|---|

| Energy | Petroleum levies, emissions from energy use | Encourages cleaner energy practices |

| Transport | Motor vehicle taxes, congestion charges | Reduces traffic pollution and emissions |

| Pollution | Waste management fees, noise pollution charges | Promotes environmental protection |

| Natural Resources | Levies on water and forest extraction | Encourages sustainable resource usage |

Climate Tagging of Subsidies

Subsidies, a significant portion of the federal budget, will now also be tag for climate impact. Using Form III-C, ministries must classify subsidies as either adaptation or mitigation. Adaptation covers agricultural risk management, crop insurance, and climate-resilient infrastructure, while mitigation focuses on clean energy, renewables, energy efficiency, mass transit, and electric vehicles.

Additionally, each subsidy will be assessed for its impact:

- Directly favourable

- Indirectly favourable

- Neutral

- Mixed

- Potentially unfavourable

This approach ensures that fiscal support reinforces environmental goals rather than contributing to climate risks.

Also Read: Pakistan National Job Portal to Receive AI Upgrade for Faster and Smarter Hiring in 2026

Disaster Budgeting and Transparency

Pakistan’s vulnerability to climate-induced disasters necessitates a dedicated disaster budgeting framework. The Finance Division has emphasized tagging disaster-related spending to cover both pre-disaster risk reduction and post-disaster recovery and reconstruction.

Pre-disaster initiatives include prevention, mitigation, and preparedness measures. Post-disaster expenditures cover response, recovery, and reconstruction activities. Each cost centre is assign a specific code to enhance tracking and transparency, ensuring that funds are efficiently utilize in emergency situations.

Also Read: Pakistan Influencer Awards Launched to Honor Digital Content Creators

Budget Timeline for FY2026-27

The FY2026-27 budget follows a structured timeline to ensure timely preparation and approval:

- January 2026: Preparation of provisional macroeconomic framework

- February 20, 2026: Submission of revised revenue and expenditure estimates

- March 30 – April 12, 2026: Budget Review Committee meetings

- April 15, 2026: Notification of exchange rate assumptions

- April 20, 2026: Approval of Budget Strategy Paper

- April 21–25, 2026: Issuance of budget ceilings for current and development budgets

- May 2026: Meetings of APCC (first week) and NEC (second week)

- End of May 2026: Finalization of all budget documents

- June 30, 2026: Submission of quarterly budget estimates

Also Read: PTA Ensures 5G Devices Pakistan Readiness Ahead of Spectrum Auction

Table: Key Budget Milestones FY2026-27

| Date | Milestone |

|---|---|

| Jan 2026 | Provisional macroeconomic framework prepared |

| Feb 20, 2026 | Ministries submit revised estimates |

| Mar 30 – Apr 12, 2026 | Budget Review Committee meetings |

| Apr 20, 2026 | Budget Strategy Paper approval |

| Apr 21–25, 2026 | Issuance of budget ceilings |

| May 2026 | APCC & NEC meetings |

| May-end 2026 | Finalization of budget documents |

| Jun 30, 2026 | Submission of quarterly estimates |

Significance of the FY2026-27 Budget Process

The FY2026-27 budget process represents a step forward in integrating fiscal planning with environmental and disaster resilience. By systematically tagging revenues, subsidies, and expenditures, the government aims to strengthen accountability and ensure that public funds support sustainable growth.

Moreover, this approach allows policymakers to balance economic recovery, climate mitigation, and disaster preparedness, helping Pakistan navigate global economic challenges while promoting sustainable development.

Also Read: GWM Pakistan Updates Tank 500 Delivery Schedule With Added Benefits for PHEV Buyers 2026

FAQs

What is the FY2026-27 Budget Process?

It is the federal government’s preparation for the next fiscal year, including macroeconomic planning, climate-focused reforms, and disaster budgeting.

What are the GDP and inflation projections for FY2026-27?

The government projects GDP growth at 5.1 percent and inflation at 6.5 percent for FY2026-27.

How does climate tagging impact the federal budget?

It ensures revenues, subsidies, and expenditures are assessed for environmental impact, promoting sustainable and green fiscal policies.

What is the budget timeline for FY2026-27?

The process includes submission of estimates, committee reviews, strategy approval, issuance of ceilings, and finalization of documents by June 30, 2026.

Also Read: Pakistan Links Power Subsidies With Benazir Income Support Programme in Major Reform Plan 2026