Parwaaz Card 3 Lakh Interest-Free Overseas Employment Loan 2026: Eligibility, Benefits & Apply Process

Parwaaz Card 2026 – Interest-Free Loan for Youth

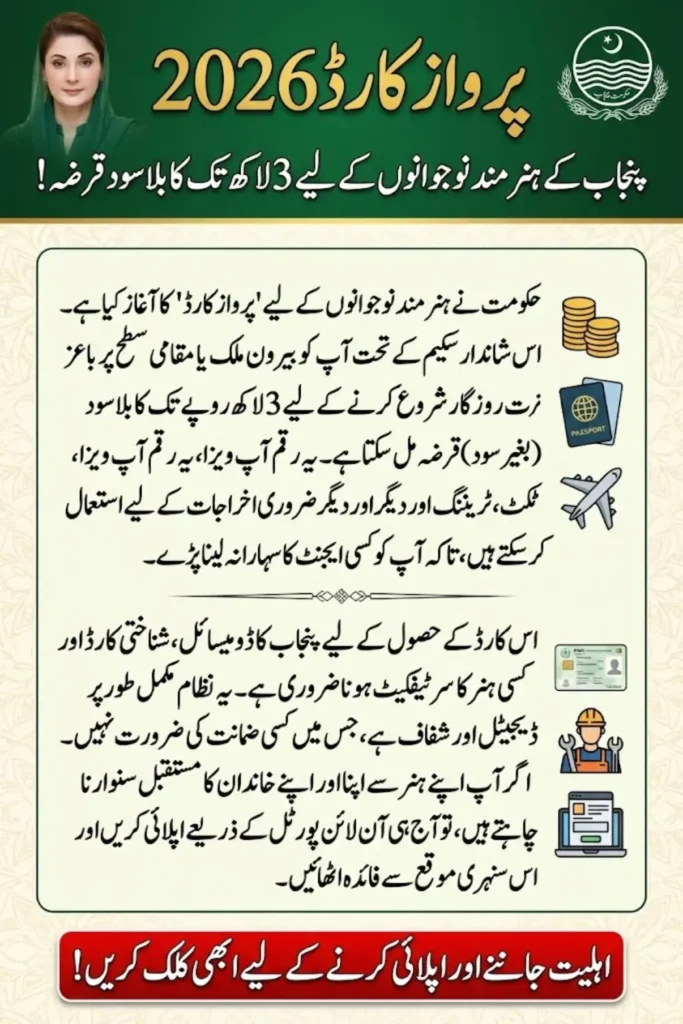

The Punjab Government has launched the Parwaaz Card 2026, a landmark initiative designed to support skilled youth who face financial barriers in pursuing employment opportunities. This program provides interest-free loans of up to Rs. 3 lakh, enabling young professionals to invest in skills, certifications, and overseas employment without relying on agents or high-interest loans.

Parwaaz Card 2026

Interest-free loan up to Rs. 3 Lakh for youth employment

Program Overview

Supporting skilled youth financially

- Interest-free loan up to Rs. 3 Lakh

- Focus on employment and skill utilization

Eligibility

Qualified and motivated youth

- Punjab domicile holders

- Valid CNIC

- Certified technical/vocational training

- Priority: transgender & marginalized youth

Loan Usage

Employment-related expenses only

- Visa & legal documentation

- Skill certification & training

- Medical & travel costs

- Initial job placement expenses

Overseas Employment Support

Safe and verified opportunities

- Reduces reliance on agents

- Legal documented placements

- Structured job support & monitoring

Application Process

Digital & transparent

- Register on official Parwaaz Card portal

- Submit CNIC & personal details

- Upload skill certificates

- Verification & approval notification

Repayment & Guidelines

Interest-free & structured

- No collateral required

- Use funds strictly for approved purposes

- Repayment scheduled post-employment

Parwaaz Card Financial Summary

| Feature | Details |

|---|---|

| Maximum Loan Amount | Rs. 3 Lakh |

| Interest Rate | 0% (Interest-Free) |

| Beneficiaries | Skilled & trained youth |

| Purpose | Employment support (local & overseas) |

| Collateral | Not required |

Important Notes

- Funds must be used strictly for approved employment-related purposes

- Program focuses on merit-based selection

- Supports safe overseas employment & structured job placements

Unlike conventional loan programs, the Parwaaz Card focuses on employment-driven financial support. The initiative bridges the gap between talent and opportunity by providing structured funding directly linked to verified training and job readiness. This ensures that skilled youth can confidently transition into professional roles both locally and abroad.

Eligibility Criteria: Who Can Apply for Rs. 3 Lakh Loan

The Parwaaz Card targets skilled and trained individuals who require financial assistance to advance their careers.

Basic Eligibility Requirements:

- Punjab domicile holders

- Valid CNIC holders

- Certified technical or vocational training graduates

- Individuals seeking local or overseas employment

Priority Groups Include:

- Transgender and marginalized youth

- Applicants planning overseas employment

- Youth actively participating in recognized skill development programs

By focusing on qualified and motivated candidates, the program ensures that financial assistance is utilized effectively, avoiding misuse or non-productive expenditure.

Also Read: 9999 PM Ramzan Relief 2026 CNIC Check, Eligibility Criteria & Cash Support Update

Key Benefits of the Parwaaz Card for Overseas Jobs

The Parwaaz Card is more than a loan; it is a comprehensive employment support system. It reduces financial risks and opens opportunities for legal, well-documented overseas employment.

Benefits for Youth:

- Interest-free loans up to Rs. 3 lakh

- Coverage for visa, certification, medical, and travel expenses

- Reduced dependence on private agents and associated scams

- Access to structured job placement support

The initiative strengthens youth employability while safeguarding families from financial exploitation. It also promotes Pakistan’s credibility in international labor markets by ensuring that trained individuals migrate through legitimate channels.

Also Read: 8070 Ramzan Relief Package 2026: Check Eligibility & Payment Status Online Using CNIC

Step-by-Step Application Process Explained

Applying for the Parwaaz Card is simple, digital, and transparent, designed to minimize delays and eliminate intermediaries.

Steps to Apply Online:

- Visit the official Parwaaz Card portal

- Submit CNIC and personal information

- Upload verified training and certification documents

- Enter skill details into the system

- Undergo verification and screening by authorities

- Receive approval for financial assistance

Also Read: Ehsaas Rashan Program 8123: CNIC Verification, New Eligibility Rules & Monthly Subsidy Update 2026

Parwaaz Card Online Application Flow

| Step | Action |

|---|---|

| 1 | Visit official portal |

| 2 | Enter CNIC & personal details |

| 3 | Upload skill certificates |

| 4 | Submit training details |

| 5 | System verification & screening |

| 6 | Loan approval notification |

This streamlined digital process ensures transparency, quick approvals, and reduced risk of fraud.

Also Read: BISP 13500 February 2026 Payment: NADRA Biometric Verification, Release Date & Collection Method

Repayment Terms, Loan Usage & Important Guidelines

The Parwaaz Card loan is strictly interest-free and designed for employment-related expenditures. The government monitors usage to ensure the funds directly contribute to job readiness and placement.

Approved Uses of Rs. 3 Lakh Loan:

- Visa and legal documentation costs

- Skill testing and medical examinations

- Professional certifications and licenses

- Initial travel or settlement expenses

- Job placement fees

Loan Guidelines:

- No collateral or guarantor required

- Beneficiaries must use funds strictly for approved purposes

- Repayment terms are structured to avoid financial strain on youth

Financial Snapshot of Parwaaz Card 2026

| Feature | Details |

|---|---|

| Maximum Loan Amount | Rs. 3 Lakh |

| Interest Rate | 0% (Interest-Free) |

| Beneficiaries | Skilled & trained youth |

| Purpose | Employment support (local & overseas) |

| Collateral | Not required |

This model protects youth from high-interest lenders and ensures a sustainable path to financial independence.

Also Read: CM Punjab Laptop Scheme 2026: Final University List Announced as Applications Close on 15 February

FAQs

Who can apply for the Parwaaz Card 2026?

Punjab residents with verified technical or vocational training, including marginalized youth and those seeking overseas employment.

What is the maximum loan amount?

Eligible applicants can receive up to Rs. 3 lakh for employment-related purposes.

Can the loan be used for personal expenses?

No, the funds are strictly for visa, certification, travel, and job placement-related costs.

Is collateral required to apply?

No collateral or guarantor is needed; the program is fully merit-based.

How is the Parwaaz Card helpful for overseas jobs?

It reduces reliance on agents, ensures legal employment, and covers visa and travel expenses safely.

Also Read: 8171 Ehsaas Program 2026 – New CNIC Verification & Rs. 13,500 Payment Update

Conclusion

The Parwaaz Card 2026 is a transformative initiative connecting skills, finance, and employment opportunities for youth in Punjab. By offering interest-free loans and structured support, the program empowers skilled individuals to pursue local and international employment with confidence. For young professionals facing financial hurdles, the Parwaaz Card is not just a loan—it is a pathway to dignity, self-reliance, and sustainable career growth.

Also Read: 8171 Ehsaas Program Check CNIC Online 13500 February Payment