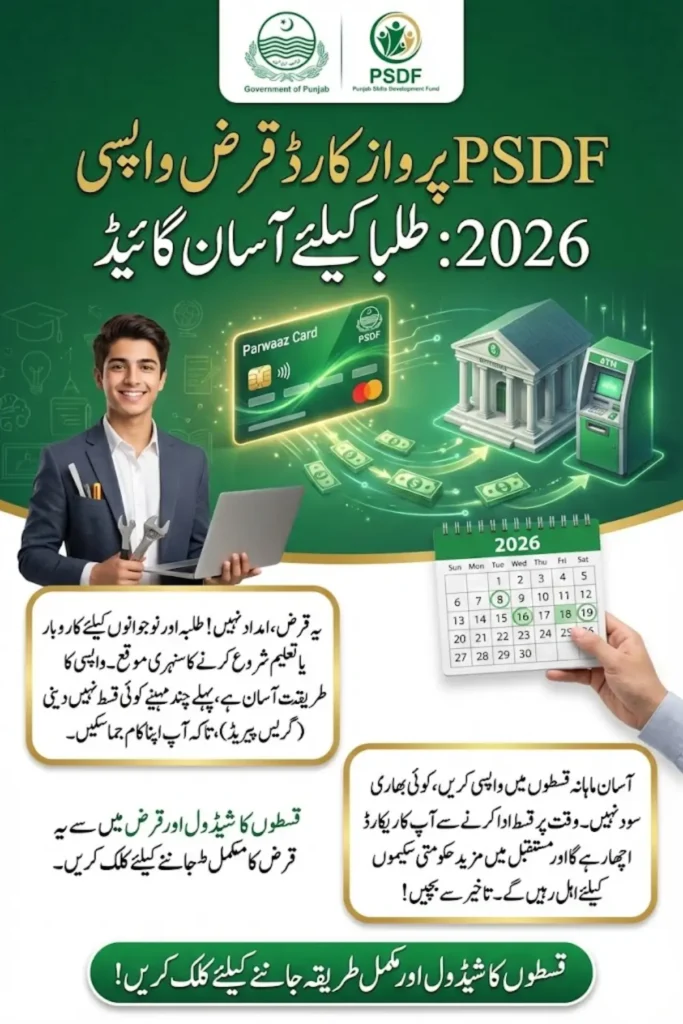

PSDF Parwaaz Card Loan Repayment 2026 – Complete Student Guide Step by Step

PSDF Parwaaz Card Loan Repayment 2026

The PSDF Parwaaz Card Loan Repayment 2026 is an important part of Punjab’s youth-focused financial support system. This program helps students and young individuals access funds for skill development, education, freelancing, and small business setup, while ensuring responsible financial behavior through a structured repayment model. Unlike grants, this loan must be repaid, making it essential for beneficiaries to fully understand the rules and timelines.

The repayment system is designed to be simple and supportive, especially for students who are just starting their professional journey. A grace period, affordable monthly installments, and digital tracking allow borrowers to manage repayments without unnecessary stress. Knowing the process in advance helps students avoid penalties and stay eligible for future government programs.

Key objectives of the repayment system include:

- Encouraging financial discipline among students

- Making loan repayment manageable through installments

- Ensuring transparency and accountability

Also Read: 8171 Ehsaas Program CNIC Check Online – Verify Eligibility & Payment

How the PSDF Parwaaz Card Loan Works

The PSDF Parwaaz Card Loan operates through a controlled digital card system. Once approved, the loan amount is loaded onto the Parwaaz Card, which can only be used for approved purposes such as education, skill training, or business-related expenses. This method ensures proper use of public funds and reduces misuse.

The program focuses on empowering students rather than offering one-time financial relief. By linking funds to specific purposes and a clear repayment plan, the loan helps beneficiaries grow professionally while learning long-term money management.

Main features of the loan system include:

- Digital card-based fund disbursement

- Usage limited to approved categories

- Mandatory repayment under agreed terms

Also Read: Diwali 2026 Holiday in Pakistan: Official Announcement for Optional Holiday on 2 February

Who Can Benefit From the Parwaaz Card Loan

This loan is mainly targeted at students, freelancers, and young entrepreneurs in Punjab. It is especially useful for those who need initial capital for equipment, training courses, or small-scale business operations. The program supports individuals who have skills and motivation but lack financial resources.

By focusing on youth and students, the Parwaaz Card Loan plays a role in reducing unemployment and promoting self-employment. It also creates opportunities for practical learning and income generation at an early stage.

Eligible beneficiaries generally include:

- Students enrolled in skill or education programs

- Young freelancers starting professional work

- Small business starters with basic plans

Also Read: PM Laptop Scheme Started Again Get Loan for Laptop

When Does PSDF Parwaaz Card Loan Repayment Start in 2026

Repayment does not begin immediately after receiving the loan. The government provides a grace period so students can focus on completing courses or setting up income sources. This approach reduces early financial pressure and increases the chances of successful repayment.

For the 2026 cycle, the grace period usually ranges from three to six months, depending on the loan type and approved amount. Monthly installments begin only after this period ends, following a fixed schedule.

Key points about repayment start time include:

- No installments during the grace period

- First payment due after grace period completion

- Monthly repayment schedule thereafter

Also Read: Punjab 3 Marla Plot Scheme Online Registration Started Apply Now for a Free Plot

Grace Period Details for Students

The grace period is a major relief feature of the PSDF Parwaaz Card Loan. During this time, students are not required to make any payments. This allows them to invest in education, tools, or business needs without worrying about immediate repayment.

This period also helps students stabilize their income. By the time repayments start, many beneficiaries are already earning or close to completing their training, making monthly installments easier to manage.

During the grace period, students can:

- Purchase equipment or learning materials

- Complete skill development programs

- Begin income-generating activities

Step-by-Step Repayment Schedule for 2026

The repayment schedule follows a clear and predictable structure. Once the grace period ends, students start paying fixed monthly installments until the loan tenure is completed. This step-by-step flow helps in financial planning and avoids confusion.

Below is an example of a typical repayment timeline for 2026:

Loan Disbursement | Grace Period | First Installment | Monthly Payments

March 2026 | 3 Months | July 2026 | July onwards

This example shows how students get enough time before repayments begin, allowing them to prepare financially.

Also Read: BISP Kafalat 2026 Payment Increase – New Update February 2026

Monthly Installment Structure and Loan Tenure

Monthly installments are calculated based on the total loan amount and selected repayment tenure. The tenure usually ranges from two to five years, depending on approval conditions. Longer tenures mean smaller monthly payments, which is helpful for students with limited income.

The installment structure is clearly mentioned in the loan agreement, ensuring transparency. Students are advised to review this agreement carefully to understand their financial commitment.

Benefits of this structure include:

- Affordable monthly installments

- Flexible repayment duration

- Clear repayment terms

Is the PSDF Parwaaz Card Loan Interest-Free

Most Parwaaz Card Loans offered to students are either interest-free or carry very low service charges. This makes the scheme accessible and affordable for young individuals who may not afford commercial loans.

All financial terms are disclosed at the time of approval. This transparency ensures that students know exactly how much they need to repay over time.

Important points to remember:

- Many student loans have zero markup

- Any service charges are minimal

- No hidden costs are involved

Also Read: Benazir Kafalat Program New Registration For Ineligible Women Started in 2026

Approved PSDF Parwaaz Card Repayment Methods

To make repayment convenient, multiple approved payment methods are available. These options allow students to pay installments without visiting offices repeatedly, saving time and effort.

Repayment reminders are also sent through SMS, helping borrowers stay on track and avoid missed payments.

Common repayment methods include:

- Automatic bank account deductions

- Payments through partner banks

- Approved digital payment channels

Consequences of Missing a Loan Installment

Missing an installment can lead to serious consequences. Even a single late payment may result in additional charges and affect the borrower’s record. Repeated delays can lead to stricter actions by authorities.

Timely repayment is not only important for loan completion but also for maintaining eligibility for future government schemes.

Possible consequences include:

- Late payment penalties

- Temporary suspension of the card

- Impact on future program eligibility

Also Read: BYD Pakistan Launches Atto 2 and Sealion 7 with Exclusive Customer Offers

Can Students Reschedule PSDF Parwaaz Loan Repayment

In genuine hardship cases, students may request rescheduling of their repayment plan. This option is not automatic and requires official approval after reviewing the reasons and supporting documents.

Rescheduling is meant to support students facing unexpected financial difficulties, not to delay payments without reason.

Key conditions for rescheduling include:

- Valid proof of financial hardship

- Official application through proper channels

- Approval by relevant authorities

How to Check Your PSDF Parwaaz Card Repayment Schedule

Students should regularly check their repayment schedule to avoid missing due dates. The government provides several ways to access this information, ensuring transparency and ease.

Staying informed helps students manage finances better and complete repayment smoothly.

You can check repayment details through:

- Official Parwaaz Card portal

- SMS alerts from banks

- Customer support helplines

Also Read: BISP 8171 Final Phase 2026: Get Payment Before 31 February

Responsibilities of PSDF Parwaaz Card Borrowers

Borrowers have clear responsibilities under this scheme. Using the loan for approved purposes and following the repayment schedule are mandatory conditions. Failure to comply can lead to penalties or disqualification.

Maintaining communication with authorities is also important if any issue arises during the loan period.

Borrower responsibilities include:

- Proper use of loan funds

- Timely installment payments

- Prompt reporting of issues

Tips for Students to Manage Loan Repayment Smoothly

Good financial planning can make repayment stress-free. Students are encouraged to set aside installment amounts in advance and avoid unnecessary spending.

Simple habits and awareness can help borrowers complete repayment without difficulty.

Helpful tips include:

- Saving installment money monthly

- Tracking SMS reminders

- Seeking help early if facing issues

Final Thoughts on PSDF Parwaaz Card Loan Repayment 2026

The PSDF Parwaaz Card Loan Repayment 2026 is designed to support students while promoting responsibility and financial discipline. With a grace period, flexible installments, and transparent terms, it provides a balanced approach to youth financing.

Students who plan carefully, follow repayment schedules, and use funds wisely can benefit greatly from this scheme while building a positive financial record for the future.

Also Read: Honhaar Scholarship Phase 2 Eligibility Criteria Required Documents and Check Online Statu

FAQs – PSDF Parwaaz Card Loan Repayment 2026

When does PSDF Parwaaz Card loan repayment start?

Repayment starts after a grace period of three to six months, depending on loan approval terms.

Is the PSDF Parwaaz Card Loan interest-free?

Most student loans under this scheme are interest-free or have very low service charges.

What happens if I miss an installment?

Missing an installment can result in penalties and may affect eligibility for future programs.

Can I reschedule my loan repayment?

Yes, but only in genuine hardship cases and after official approval.

How can I check my repayment schedule?

You can check it through the official Parwaaz Card portal, SMS alerts, or helplines.

Also Read: Honhaar Scholarship Phase 2 Eligibility Criteria Required Documents and Check Online Statu